Craig

W. Holden

Craig W. Holden is the Finance Department Chair and the Gregg T. and Judith A. Summerville Chair of Finance at the Kelley School of Business at Indiana University. His M.B.A. and Ph.D. are from the Anderson School at UCLA. He is the winner of multiple research awards (including a Fama/DFA Prize, a Spangler-IQAM Prize, and a Philip Brown Prize) and multiple teaching awards. His research on market microstructure has been published in leading academic journals and has been cited more than 4,700 times (see his Google Scholar profile). He has chaired 22 dissertations, been a member or chair of 62 dissertations, serves as an Associate Editor of the Journal of Financial Markets, serves as the Secretary-Treasurer of the Society for Financial Studies, and serves on the program committees of the Western Finance Association and European Finance Association. He has written Excel Modeling in Investments Fifth Edition, Excel Modeling in Corporate Finance Fifth Edition, and there are International, Chinese, and Italian editions. He served on the campus tenure advisory committee for three years, served on the school faculty review committee for two years, chaired the school's teaching and service excellence committee for six years, chaired the department doctoral committee for four years, and chaired the department undergraduate committee for thirteen years. He has led several major curriculum innovations in the finance department. For more details, here is Craig's CV.

Virtual Conference

![]() How to Run

a Large-Scale Virtual Conference <= Insights from the first large-scale

finance conference to be run virtually!

How to Run

a Large-Scale Virtual Conference <= Insights from the first large-scale

finance conference to be run virtually!

Working Papers (see his SSRN

author page)

![]() Holden, Lin, Lu, Wei, and Yang, The Effect of Secondary Market Existence on

Primary Market Liquidity: Theory and Evidence from a Natural Experiment in

Peer-to-Peer Lending

Holden, Lin, Lu, Wei, and Yang, The Effect of Secondary Market Existence on

Primary Market Liquidity: Theory and Evidence from a Natural Experiment in

Peer-to-Peer Lending

![]() Holden,

Mao, and Nam, Price Discovery in the Stock, OTC Corporate Bond, and NYSE

Corporate Bond Markets

Holden,

Mao, and Nam, Price Discovery in the Stock, OTC Corporate Bond, and NYSE

Corporate Bond Markets

![]() Fong, Holden, and

Tobek,

Are Volatility Over Volume Liquidity Proxies Useful For Global Or US Research?

Fong, Holden, and

Tobek,

Are Volatility Over Volume Liquidity Proxies Useful For Global Or US Research?

Published or Forthcoming Papers

![]() 1. Holden,

Lu, Lugovskyy, and Puzzello, 2021, What is the Impact of Introducing a Parallel

OTC Market? Theory and Evidence from the Chinese Interbank FX Market, Journal of

Financial Economics 140, 270-291

1. Holden,

Lu, Lugovskyy, and Puzzello, 2021, What is the Impact of Introducing a Parallel

OTC Market? Theory and Evidence from the Chinese Interbank FX Market, Journal of

Financial Economics 140, 270-291

![]() 2. Holden and

Nam, 2019, Do the LCAPM Predictions Hold? Replication and Extension Evidence,

Critical Finance Review 8,29-71.

Code

2. Holden and

Nam, 2019, Do the LCAPM Predictions Hold? Replication and Extension Evidence,

Critical Finance Review 8,29-71.

Code

![]() 3. Fong, Holden, and Trzcinka,

2017, What Are The Best Liquidity Proxies For Global Research?, Review of Finance

21, 1355-1401 (lead article).

Supplemental Appendix

3. Fong, Holden, and Trzcinka,

2017, What Are The Best Liquidity Proxies For Global Research?, Review of Finance

21, 1355-1401 (lead article).

Supplemental Appendix

* Won Spangler-IQAM Prize = Best Paper in

Investments published in the Review of Finance in the academic year

17-18.

* Won Philip Brown Prize = Best Paper using

Securities Industry Research Centre of Asia-Pacific (SIRCA) data that was

published in 2017.

![]() 4. Holden and

Kim, 2017, Performance Share Plans: Valuation and Empirical Tests, Journal of Corporate Finance

44, 99-125.

4. Holden and

Kim, 2017, Performance Share Plans: Valuation and Empirical Tests, Journal of Corporate Finance

44, 99-125.

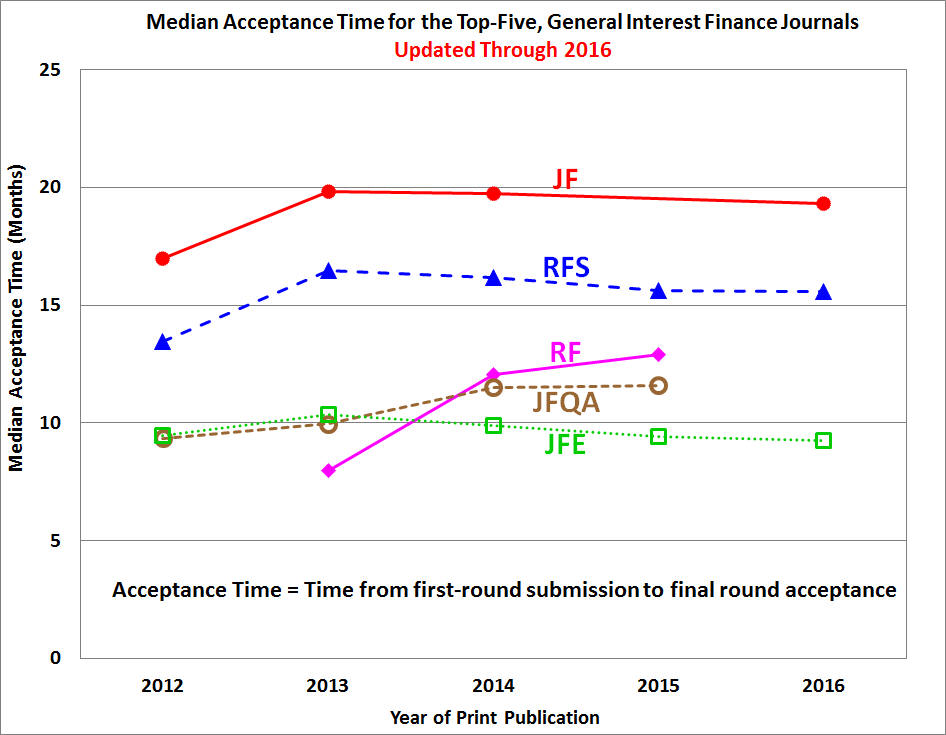

![]() 5. Holden,

2017, Do Acceptance and Publication Times Differ Across Finance Journals?, Review of Corporate Finance Studies

6, 102-126.

Updated Through 2016:

Journal Speed

Report

Journal Speed Data

5. Holden,

2017, Do Acceptance and Publication Times Differ Across Finance Journals?, Review of Corporate Finance Studies

6, 102-126.

Updated Through 2016:

Journal Speed

Report

Journal Speed Data

![]() 6. Holden,

Jacobsen, and Subrahmanyam Review Article, 2014, The Empirical Analysis of

Liquidity, Foundations and

Trends in Finance 8, No 4, 263-365.

6. Holden,

Jacobsen, and Subrahmanyam Review Article, 2014, The Empirical Analysis of

Liquidity, Foundations and

Trends in Finance 8, No 4, 263-365.

![]() 7. Holden and

Jacobsen,

2014, Liquidity Measurement Problems in Fast, Competitive Markets: Expensive and Cheap

Solutions, Journal of Finance 69, 1747-1785. Supplemental

Appendix

7. Holden and

Jacobsen,

2014, Liquidity Measurement Problems in Fast, Competitive Markets: Expensive and Cheap

Solutions, Journal of Finance 69, 1747-1785. Supplemental

Appendix

* SAS

code to implement our recommended solutions for Daily TAQ (DTAQ) and Monthly TAQ

(MTAQ):

Code

<== Updated for the new Nanosecond timestamps!

* This SAS code runs in the WRDS Cloud (or

on a PC) to obtain DTAQ or MTAQ data for firms and dates that

you specify, cleans the data, computes the complete NBBO, and computes standard

liquidity measures.

* Our article points out, the “NBBO” file

in DTAQ is incomplete by itself. So our DTAQ code combines both the “NBBO” and

“Quote” files to compute the official complete NBBO.

* Our article finds that there are three

different types of errors in the MTAQ. Our MTAQ code implements our recommended

clean-up steps to fix the MTAQ data as best as possible.

* Step-by-step instructions for running our

SAS code in the WRDS Cloud to obtain DTAQ and MTAQ data:

Instructions

![]() 8. Bhattacharya,

Holden, and Jacobsen, 2012, Penny Wise, Dollar Foolish: Buy-Sell Imbalances On

and Around Round Numbers, Management Science.15, 413-431.

Supplemental Appendix

8. Bhattacharya,

Holden, and Jacobsen, 2012, Penny Wise, Dollar Foolish: Buy-Sell Imbalances On

and Around Round Numbers, Management Science.15, 413-431.

Supplemental Appendix

![]() 9. Goyenko, Holden, and

Trzcinka, 2009, Do Liquidity Measures Measure Liqudity? Journal

of Financial Economics 92, 153-181 (lead article).

9. Goyenko, Holden, and

Trzcinka, 2009, Do Liquidity Measures Measure Liqudity? Journal

of Financial Economics 92, 153-181 (lead article).

* Won Fama/DFA Prize = Second Prize for Best Paper in Capital Markets and Asset

Pricing published in the Journal of Financial Economics in 2009.

![]() 10. Holden, 2009, New Low-Frequency Spread Measures,

Journal of Financial Markets 12, 778-813." Detailed

Examples for any Decimal or Fractional Price Grid

10. Holden, 2009, New Low-Frequency Spread Measures,

Journal of Financial Markets 12, 778-813." Detailed

Examples for any Decimal or Fractional Price Grid

![]() 11. Holden and Lundstrum, 2009,

Costly Trade, Managerial Myopia, and Long-Term Investment, Journal of Empirical Finance 16, 126-135."

11. Holden and Lundstrum, 2009,

Costly Trade, Managerial Myopia, and Long-Term Investment, Journal of Empirical Finance 16, 126-135."

![]() 12. Holden and Stuerke, 2008, The Frequency of Financial

Analysts' Forecast Revisions: Theory and Evidence about Determinants of Demand

for Predisclosure Information, Journal of Business

Finance and Accounting 35, 860-888.

12. Holden and Stuerke, 2008, The Frequency of Financial

Analysts' Forecast Revisions: Theory and Evidence about Determinants of Demand

for Predisclosure Information, Journal of Business

Finance and Accounting 35, 860-888.

![]() 13. Ellul,

Holden, Jain, and Jennings, 2007, Order Dynamics: Recent Evidence from the NYSE,

Journal of Empirical Finance 14, 636-661."

13. Ellul,

Holden, Jain, and Jennings, 2007, Order Dynamics: Recent Evidence from the NYSE,

Journal of Empirical Finance 14, 636-661."

![]() 14. Craig W. Holden

and Avanidhar Subrahmanyam, 2002, News Events, Information Acquisition, and

Serial Correlation,

Journal of Business 1, 1-32 (lead article).

14. Craig W. Holden

and Avanidhar Subrahmanyam, 2002, News Events, Information Acquisition, and

Serial Correlation,

Journal of Business 1, 1-32 (lead article).

![]() 15. Robert Battalio and Craig W. Holden, 2001, A Simple Model of Payment For Order Flow,

Internalization, and Total Trading Costs, Journal of

Financial Markets 4,

33-71.

15. Robert Battalio and Craig W. Holden, 2001, A Simple Model of Payment For Order Flow,

Internalization, and Total Trading Costs, Journal of

Financial Markets 4,

33-71.

![]() 16. Mark Bagnoli, S. Viswanathan, and Craig W. Holden, 2001, On The Existence of Linear Equilibria in Models of Market Making,

Mathematical

Financel 11, 1-31.

16. Mark Bagnoli, S. Viswanathan, and Craig W. Holden, 2001, On The Existence of Linear Equilibria in Models of Market Making,

Mathematical

Financel 11, 1-31.

![]() 17. Craig

W. Holden and Avanidhar Subrahmanyam, 1996, Risk Aversion, Liquidity, and

Endogenous Short Horizons, The Review of

Financial Studies.9, 691-722.

17. Craig

W. Holden and Avanidhar Subrahmanyam, 1996, Risk Aversion, Liquidity, and

Endogenous Short Horizons, The Review of

Financial Studies.9, 691-722.

![]() 18. Sugato

Chakravarty and Craig W. Holden, 1995, An Integrated Model Of Market And Limit Orders,

Journal of Financial Intermediation.4, 213-241.

18. Sugato

Chakravarty and Craig W. Holden, 1995, An Integrated Model Of Market And Limit Orders,

Journal of Financial Intermediation.4, 213-241.

![]() 19. Craig

W. Holden, 1995, Index Arbitrage As Cross-Sectional Market Making,

The

Journal of

Futures Markets

15, 423-455.

19. Craig

W. Holden, 1995, Index Arbitrage As Cross-Sectional Market Making,

The

Journal of

Futures Markets

15, 423-455.

![]() 20. Craig

W. Holden and Avanidhar Subrahmanyam, 1994, Risk Aversion, Imperfect

Competition, and Long-Lived Private Information, Economic

Letters 44, 181-190.

20. Craig

W. Holden and Avanidhar Subrahmanyam, 1994, Risk Aversion, Imperfect

Competition, and Long-Lived Private Information, Economic

Letters 44, 181-190.

![]() 21. Craig

W. Holden and Avanidhar Subrahmanyam, 1992, Long-Lived Private Information and

Imperfect Competition, The Journal of Finance 47, 247-270.

21. Craig

W. Holden and Avanidhar Subrahmanyam, 1992, Long-Lived Private Information and

Imperfect Competition, The Journal of Finance 47, 247-270.

![]() 22. Craig

W. Holden, 1991, Index Arbitrage and The Media,

Financial

Analysts Journal 47, 8-9.

22. Craig

W. Holden, 1991, Index Arbitrage and The Media,

Financial

Analysts Journal 47, 8-9.

Published or Forthcoming Society

for Financial Studies Annual Reports

![]() 23.

Chan, Ellul, Goldstein, Holden, Piazzesi, and Pontiff, 2021, The Annual Report

of the Society for Financial Studies for 2019-2020, forthcoming in the

Review of Financial Studies.

23.

Chan, Ellul, Goldstein, Holden, Piazzesi, and Pontiff, 2021, The Annual Report

of the Society for Financial Studies for 2019-2020, forthcoming in the

Review of Financial Studies.

![]() 24. Ellul, Goldstein, Holden, Masulis, Pontiff, and Schoar, 2020, The Annual Report

of the Society for Financial Studies for 2018-2019,

Review of Financial Studies 33, 991-1008.

24. Ellul, Goldstein, Holden, Masulis, Pontiff, and Schoar, 2020, The Annual Report

of the Society for Financial Studies for 2018-2019,

Review of Financial Studies 33, 991-1008.

Excel Modeling Books

![]() Complete information,

free samples,

and desk copy requests of my

Excel

Modeling books are available at:

Complete information,

free samples,

and desk copy requests of my

Excel

Modeling books are available at:

www.excelmodeling.com

Teaching Papers and Materials

![]() Craig

W. Holden

and Kent L. Womack, 2000, Spreadsheet Modeling in Finance and Investment

Courses,

FEN Educator 5, No 5

Craig

W. Holden

and Kent L. Womack, 2000, Spreadsheet Modeling in Finance and Investment

Courses,

FEN Educator 5, No 5

![]() Craig W. Holden, 1998, Save Diversification From The CAPM

Controversy! An Excel-based Interactive Optimizer To Teach Diversification,

Exploiting Mispriced Assets, and Asset Classes, Journal of Financial Education 24, 49-47.

Craig W. Holden, 1998, Save Diversification From The CAPM

Controversy! An Excel-based Interactive Optimizer To Teach Diversification,

Exploiting Mispriced Assets, and Asset Classes, Journal of Financial Education 24, 49-47.

![]() Holden and Smart, 2000, Two Thumbs Up: An Excel-based

"Movie" To Teach Term Structure Dynamics

Holden and Smart, 2000, Two Thumbs Up: An Excel-based

"Movie" To Teach Term Structure Dynamics

![]() Syllabus of Undergraduate Market Microstructure

Course (F335)

Syllabus of Undergraduate Market Microstructure

Course (F335)

![]() Syllabus of MBA Market Microstructure

Course (F535)

Syllabus of MBA Market Microstructure

Course (F535)

![]() Syllabus of Ph.D. Asset Pricing Theory

Course (F600)

Syllabus of Ph.D. Asset Pricing Theory

Course (F600)

![]() Syllabus of Ph.D. Market Microstructure Course

(F635)

Syllabus of Ph.D. Market Microstructure Course

(F635)

![]() Syllabus of Faculty Teaching Seminar ||

Schedule

Syllabus of Faculty Teaching Seminar ||

Schedule

![]() Syllabus of Doctoral Teaching Seminar (X630)

Syllabus of Doctoral Teaching Seminar (X630)

![]() Syllabus of Intermediate Finance (F303) ||

Proj1 || Proj2 ||

Proj3 || Proj4 ||

Data

Syllabus of Intermediate Finance (F303) ||

Proj1 || Proj2 ||

Proj3 || Proj4 ||

Data

Service Results

![]() Secretary-Treasurer Financial

and Policy Reports, Society

For Financial Studies (2012 - Present)

Secretary-Treasurer Financial

and Policy Reports, Society

For Financial Studies (2012 - Present)

![]() Chair of the Finance Dept Undergraduate Committee (1994 -

2005)

Chair of the Finance Dept Undergraduate Committee (1994 -

2005)

![]() Member of 1997 Dean Search and Screen Committee.

Member of 1997 Dean Search and Screen Committee.

![]() Chair of 1995 Dean's Task Force on Science, Engineering, and Technology.

Chair of 1995 Dean's Task Force on Science, Engineering, and Technology.

Resources for Doctoral Students

![]() Career Resources

Career Resources